Welcome. In this article, David Aughinbaugh II, one of our Research Analysts, reviews The Walt Disney Company’s fourth quarter (Q4) 2019 earnings results. David provides a complete Walt Disney Company financial analysis of 2019 Q4 that starts with a review of the company’s top and bottom-line results (revenue and earnings/profit). As with most of our financial analysis reports, David then reviews the overall performance of the company in the quarter. Key information is covered and is then followed by a review of segment/division performance. An analysis of the firm’s cash flows is covered next. At the end of the article is an analysis of how the quarter met expectations and details on what to watch going forward.

This article also covers some of the 2019 fiscal year results for Disney as this was their last quarter for their accounting year.

Presentation for the 4th Quarter

The Walt Disney Company Financial Summary 4th Quarter of 2019

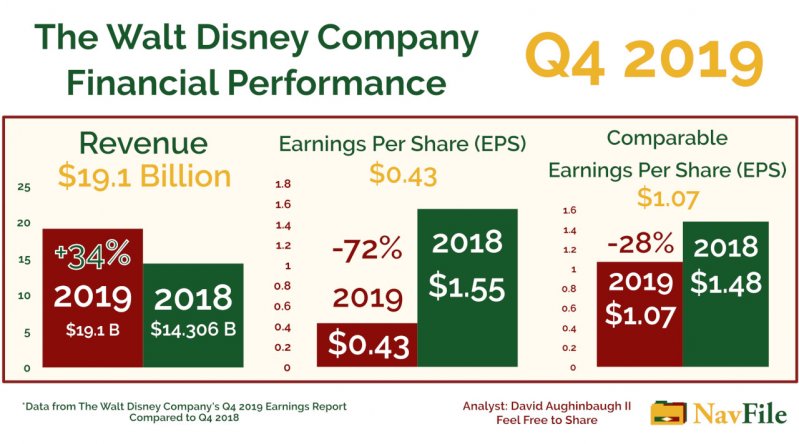

After the bell on November 7th, 2019, The Walt Disney Company reported earnings for the final quarter of the fiscal year 2019. Revenue for the company was $19.1 billion. Diluted earnings per share (EPS) came in at $0.43. As part of its results, Walt Disney is also providing EPS excluding items that affect comparisons with last year’s quarter. Comparable EPS for the quarter was $1.07. In comparison to the last quarter, revenues were up 34 percent from $14.306 billion (2018 Q4). EPS was down 72 percent when compared to 2018 Q4’s $1.55 per share result. Excluding certain items affecting comparability, EPS was down 28 percent from $1.48 (Comparable EPS).

Analyst Expectations

According to CNBC, the average analyst estimates for revenues was $19.04 billion, which was virtually in line with what Walt Disney Co. reported ($19.1 billion). Comparable EPS estimates were for $0.95 a share vs the actual $1.07 comparable EPS that the company reported (12.6 percent increase). The solid beat on profits was a welcome development when compared to the last quarter. In this quarter, Disney returned to its trend of beating financial analyst estimates.

2019 Fiscal Year Results

The Walt Disney Company reported that EPS from continuing operations was $6.27 for the year, down 25 percent from $8.36 in 2018. Comparable EPS came in at $5.77, compared to $7.08 in the prior year (19 percent decrease).

The overall 2019 performance of the firm will be covered in a separate post.

Above is the logo for The Walt Disney Company that features MIckey Mouse

2019 Q4 Overview – The Walt Disney Company Financial Analysis

For 2019 Q4, The Walt Disney Company rose above analyst estimates and reported solid results. Even though comparable EPS was significantly below last year’s quarter, the company was able to report results that most investors seemed to like. Earnings at Walt Disney Co.’s segments were mixed; however, Parks, Experiences, and Products and Studio Entertainment were up by good margins. Parks, Experiences, and Products had a 17 percent increase and Studio Entertainment was up 79 percent from Q4 2018. Media Networks saw slightly lower segment operating income when compared to Q4 2018. Direct-to-Consumer and International continued its trend of increased losses during the quarter.

Solid results from Parks, Experiences, and Products and outstanding results from Studio Entertainment helped to propel the company’s positive results in the quarter. Below is more information on key parts of the company’s earnings release.

2019 Q4 Financial Results – Key Information

- Disney is still incurring costs with the integration of 21st Century Fox (TFCF) into the company. As a side note, the firm previously abbreviated 21st Century Fox as 21CF. The company changed the name of the division to TFCF Corporation during the quarter.

- 21st Century Fox integration costs are still negatively affecting Disney results.

- Studio Entertainment was the big driver of positive results for the quarter. 79 percent segment operating income increase from 2018 Q4.

- Toy Story 4, The Lion King, and Aladdin all helped Studio Entertainment deliver amazing results.

- Parks, Experience, and Products bounced back from last quarter’s slight downturn and saw its segment operating income increase 17 percent from 2018 Q4.

- Media Networks had relatively flat results with segment operating income down 3 percent from 2018 Q4. Revenues rose 22 percent, however. Operating income declines were due to performance at ESPN, legacy broadcasting operations, and lower-income from A+E Television Networks.

- Direct-to-Consumer and International had significantly increased operating losses; however, that was expected. Revenues increased significantly.

- Disney+ was launched on November 12th, 2019, a few days after the earnings announcement. The company announced that it had 10 million subscribers a few days after the launch, which was a big surprise. Walt Disney’s stock soared after the announcement.

- Developments at Disney+ have answered questions on whether the streaming service can help the company grow.

- Going forward Direct-to-Consumer and International will be the big segment to watch as the company reports on how the division is performing.

- Studio Entertainment and Parks, Experiences, and Products were the two segments that helped the company beat financial analysts' expectations.

Above is a graphic that charts comparing the revenue, earnings per share (EPS), and comparable EPS for the 4th quarter of 2019 compared to Q4 2018. The chart graphic is by David Aughinbaugh II.

The Walt Disney Company Financial Analysis Q4 Overview

For the fourth quarter of 2019, Walt Disney Co. beat analyst expectations and bounced back from its Q3 results that missed expectations. The main driver of the company’s positive results was Studio Entertainment’s movie lineup, which drove double-digit growth in the segment’s revenue and profit. Revenues were up 52% and earnings and operating income was up 79% from last year’s quarter! In addition, Parks, Experiences, and Products saw its revenues and operating income increase by 8% and 17% respectively.

Media Networks had results that included a 22% increase in revenue; however, operating income decreased by 3 %. Cable Networks and Broadcasting saw sharp revenue increases combined with operating losses. ESPN and legacy operations (ABC Studios & Television Network) were the main drivers of negative results at the division. Those results are slightly concerning; however, the company did note that the integration of 21st Century Fox did help the results of the segment.

Direct-to-Consumer and International had large increases in operating losses; however, revenues increased significantly in the quarter also. Increases in losses were due to the inclusion of Hulu in the company’s results, and the costs associated with preparing Disney+ for launch, and the cost of operating the ESPN+ platform.

Parks, Experiences, and Products had solid results that also played a big role in the company’s success in the quarter. The segment had revenues and operating income that was up from last year’s quarter. Operating income was up 17% from Q4 2018, a solid increase.

The continued integration of 21st Century Fox also continued to cost the company money as they continued to incur expenses with the transaction. Corporate and allocated shared expenses increased 48.55 percent to $309 million due to costs associated with 21st Century Fox integration. Restructuring charges were $314 million for the quarter.

Segment Financial Results

In this section and an overview of the performance of each segment (division) of the company is covered.

Studio Entertainment

Studio Entertainment was the big winner in the quarter for the company. The segment had revenues that were up 52% to $3.3 billion. Operating income was up even more percentage-wise as Walt Disney Co. reported that profit came in at $1.079 billion, up 79% from last year. Movies including Toy Story 4, The Lion King, and Aladdin were all highly successful at the box office. Those movies were able to beat out last year’s results from Incredibles 2 and Ant-Man and the Wasp. Results at the company’s 21st Century Fox’s operations did drag on the results slightly. The firm’s TFCF businesses incurred a loss from the performance of their movies.

Media Networks

For the quarter, media networks had neutral to negative results. Revenues were up 22% to $6.5 billion; however, operating income came in at $1.8 billion, a 3% decline from last year’s quarter. Below is a breakdown of the company’s results for each of the sub-segments that are part of Media Networks.

Cable Networks

The Cable Networks portion of the division saw its income decline $19 million to $1.3 billion based on decreases at ESPN. Revenue was down 20 percent to $4.2 billion, also. 21st Century Fox consolidation helped to reduce the decline for Cable Networks; however. ESPN was affected by increased production, marketing, and programming expenses, which was slightly offset by increased affiliate revenue. Increased programming expenses were driven by higher rates for NFL, MLB, and college sports programming. Disney also reported that there was a decrease in subscribers for the quarter.

Broadcasting

Operating income for Broadcasting was down $17 million to $377 million even though revenues increased 26 percent to $2.3 billion. Walt Disney Company attributed the decline to the firm’s legacy operations, a decrease in advertising revenue, production costs at ABC Television Network, and increased marketing costs. Affiliate revenues were up due to higher rates. ABC Studios’ income decrease was due to the lower performance of Daredevil, Iron Fist, and Black-ish programs. Programming costs were up because of write-downs and an increase in the average cost of network programming. A drop in rates at company-owned television stations was the cause of lower advertising revenue in the quarter.

Equity in the Income of the Investees

This sub-segment saw its income decreased $23 million to $150 million. The drop was caused by A+E Television Networks’ lower advertising and affiliate revenue and higher marketing costs.

The slightly lower performance of all of the firm’s sub-segments led Media Networks to post

income results that were down slightly.

Direct-to-Consumer and International

In the quarter, Direct-to-Consumer and International saw its revenues increase sharply (325%) to $3.4 billion; however, losses also increased $400 million to $740 million. Operating loss increases were due to the upcoming launch of Disney+, operations at ESPN+, and the combination of Hulu into the segment. The losses were slightly offset by 21st Century Fox operations and Star India income. The next week after the quarterly earnings announcement, the company launched Disney+. The launch was met with great demand as the company reported that it had 10 million people sign up for the service within the first day. As a result of the strong demand for the streaming service, the company’s stock rose to 52-week highs.

Above: The Disney+ Logo.

Parks, Experiences, and Products

This segment had revenues that were up 8% to $6.7 billion and operating income that was up 17% to $1.4 billion. Disneyland Resort, Disney Vacation Club, and merchandise licensing increases were the drivers of high income in the quarter. Better performance at Disneyland Resort (California) was attributed to increased guest spending. Increased guest spending was due to higher average ticket prices, and increased beverage, merchandise, and food spending. Even with the increase in guest spending, the resort saw lower attendance and increased costs due to Star Wars: Galaxy’s Edge.

Disney Vacation Club was positively impacted by sales of Disney’s new Riviera Resort in Florida. Walt Disney World Resort’s results were in line with last year’s result. That resort saw increases in guest spending, occupied room nights, and increased attendance; however, those increases were offset by higher costs. As with Disneyland, Walt Disney World's results affected by higher food spending and increased average ticket prices. Higher costs were driven by the launch of Star Wars: Galaxy’s Edge and “cost inflation”.

International parks' income was also in line with last year. Hong Kong Disneyland Resort had results that were lower than last year; however, Shanghai Disney Resort and Disneyland Paris all had higher results, which balanced out the declines. Hong Kong Disneyland was impacted by lower attendance and occupied room nights. The results for that resort may be transitory as the region is being affected by a large scale event. Performance at Shanghai Disney was increased based on higher average ticket prices. The resort, however, saw lower attendance in the quarter. Disneyland Paris’ results were positively impacted by increased attendance and higher ticket prices (average).

Details on the performance of Tokyo Disneyland were not provided by Disney.

Above is a rendering of the new Epcot that was created by The Walt Disney Company in 2019. Copyright Disney.

Merchandise Licensing

The Walt Disney Company’s licensing business had increases in revenue from Toy Story and Frozen merchandise. Licensing sales were slightly impacted by lower sales for Mickey Mouse and Minnie Mouse merchandise.

Parks, Experiences, and Products had a great quarter that was driven by Disneyland, Disney Vacation Club, and merchandise licensing. Walt Disney World results had flat results that were driven by increased spending and ticket prices and higher prices. International parks did well except for Hong Kong Disneyland, which is being impacted by a major event in the region.

Cash Flow Analysis

Quarter Cash Flow Analysis

For the quarter, cash provided by operations was at $1.718 billion, down $2.135 billion from Q4 2018 (55 percent decrease). Free cash flow for Q4 was $409 million compared to $2.652 billion for Q4 2018 (84.6 percent decline). Disney does not provide a full breakdown of cash flow quarterly; however, investments in parks, resorts, and other property did increase by $108 million from Q4 2018 to $1.309 billion (8.3 percent increase). For more information on the yearly cash flows for the company, including a full breakdown, please see the section below.

Yearly Cash Flow Analysis - 2019

Cash flows for the year (cash provided by operations) were down $8.3 billion from 2018 to $5.984 billion (58 percent decline). The large decrease was caused by the company having to pay tax obligations for the spin-off of Fox Corporation in the 21st Century Fox transaction, lower segment operating income, sale of the regional sports networks from the TFCF transaction, higher pension costs, higher interest payments, and an increase in spending for film and TV products.

Free cash flow for the year was $1.08 billion, down from $9.83 billion that was reported for last year (89 percent drop). The decrease in cash provided by operations (primary driver) combined with a slight increase in investments in parks, resorts, and other property were the drivers of the sharp decline in available free cash.

The Walt Disney Company increased its capital expenditures spending on parks, resorts, and other property by $411 million to $4.876 billion for the year (9.2 percent increase). The increases in capital expenditures were mostly from Parks, Experiences, and Products, Direct-to-Consumer and International, and Corporate spending.

Why The Walt Disney Company Beat Expectations

For the most part, The Walt Disney Company’s fourth-quarter results beat financial analyst expectations. Studio Entertainment was the large driver of positive results as the division saw its profits increase by 79% from last year. The segment’s strong movie lineup for the quarter (Toy Story, The Lion King, and Aladdin) was behind the strong results. Following Studio Entertainment was Parks, Experiences, and Products, which saw its profits increase by 17%. Disney Vacation Club and Disneyland Resort California helped the segment report a strong increase in earnings. Media Networks saw its profits slightly decline (-3%); however, revenue was up for the quarter. Direct-to-Consumer and International saw increased losses and increased revenue. Despite the losses, revenues increased significantly (325%) in comparison to the growth in losses (118%).

Compared to last year’s quarter, net income declined by $1.268 billion to $1.054 billion (54.6% decline). Cost and expenses were one of the main drivers of the decline in earnings as costs increased $5.592 billion to $16.815 billion (50% increase). Analysts, however, had accounted for this in their forecasts and the company was able to beat expectations.

Studio Entertainment’s and Parks, Experiences, and Products’ performance was the main reason why Walt Disney Co. had solid Q4 2019 results.

Analysis on What to Watch Going Forward

Going forward, the main segment to watch will Direct-to-Consumer and International. Disney+ was launched right after the quarter and has had success in gaining subscribers. Further information on the performance of the firm’s streaming services will important as it will help analysts understand the trajectory of the division. If The Walt Disney Company can turn Direct-to-Consumer and International into a profitable segment, it will allow the company to grow significantly.

To a lesser extent, the performance of Walt Disney World Resort and Media Networks are some other key areas to watch. Walt Disney World Resort had flat results for the quarter and details on the performance of the resort for Q1 2020 will be important. Media Networks is another key segment to watch as its performance has been flat to slightly trending downward. If Media Networks can have stable results, the company will be in good shape.

Quarter Review

The Walt Disney Company’s 2019 4th Quarter results beat Wall Street analyst expectations and the company rebounded from the mixed 3rd quarter results that it had. Studio Entertainment led the way and Parks, Experiences, and Products was able to bounce back from the slow down in growth in the last quarter. Media Networks slowed down and had a decline in income. Direct-to-Consumer and International continued its trend of increasing losses; however, revenues were up over 300%. The combined performance of all of the company’s segments was able to help the firm have a solid 4th quarter.