This article/report covers The Walt Disney Company’s 2019 3rd quarter (2019 Q3) financial results and provides a financial analysis of the quarter by David Aughinbaugh II, NavFile’s Chief Research Analyst. An overview of the top line and bottom-line results of the quarter compared to Wall Street expectations and last year’s figures are provided to start with. Analysis and a key information about the quarter are provided next. Following that section is a recap and analysis of the each segment’s results. Cash flows, why the company missed expectations, and a financial outlook is provided at the end of this article. A PowerPoint presentation in PDF format, complementing this report, is linked below.

PowerPoint Presentation of the Quarter

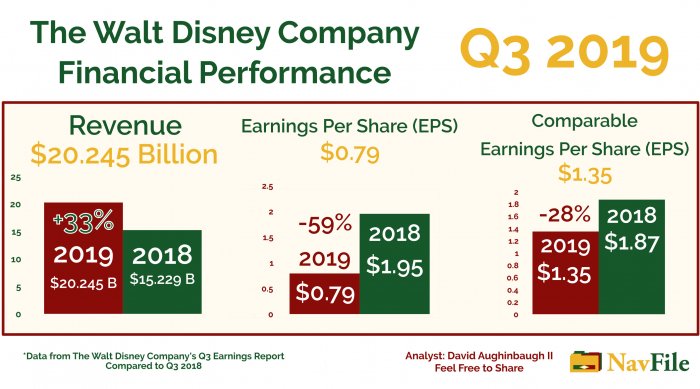

3rd Quarter 2019 Results – The Walt Disney Company Financial Summary

On August 8th, 2019, The Walt Disney Company reported earnings for the third quarter of 2019. Walt Disney Co. reported financial results that included earnings per share (EPS) of $0.79 and comparable EPS of $1.35. Revenues came in at $20.245 billion. Revenues and earnings per share came in below Wall Street estimates that were at $1.75 for EPS and $21.740 billion according to Reuters. Disney had been meeting or exceeding analyst estimates for the past several quarters and this quarter’s results was a rare miss for the company. Compared to last year’s quarter the company's earnings per share declined by 59 percent ($0.79 Vs. $1.95 2018 Q3), 28 percent for comparable EPS ($1.35 Vs. $1.87 2018 Q3). Revenues were up 33 percent ($20.245 billion Vs. $15.229 billion 2018 Q3) when compared to last years quarter. Segment operating income, the income that Walt Disney Co.’s divisions generate, was at $3.961 billion for the quarter. When compared to last years quarter, the company had a 5 percent decline in segment operating income ($3.961 billion Vs. $4.189 billion 2018 Q3).

Above Photo: The Walt Disney Company Logo Featuring Mickey Mouse Walking

The Walt Disney Company Financial Analysis 2019 Q3 Overview

The Walt Disney Company reported earnings that did not meet analyst expectations and reported income that was below last year’s quarter. Most of Disney’s segments or divisions did have income that was above last year’s results, however. During the 3rd quarter, Parks, Experiences, and Consumer Products, Media Networks, and Studio Entertainment all had segment operating income that was above 2018 Q3 results. Direct-to-Consumer and International reported losses that were significantly above Q3 2018’s losses. The loss in Direct-to-Consumer and International was a contributing factor that caused The Walt Disney Company to miss expectations for the quarter. Losses in that segment increased to $553 million from $168 million during the third quarter of 2018 (229% increase). If losses had stayed around the $168 million figure that the company reported in 2018, Disney would have had segment operating income that exceeded Q3 2018’s income. Direct-to-Consumer and International’s performance was the driving factor that caused the firm to miss expectations for segment operating income. Increased expenses were the primary factor that caused Walt Disney Co. to report declines in income and earnings per share. Those increased expenses were a reflection of the costs to integrate 21st Century Fox into the company.

2019 Q3 Financial Results – Key Information

- Revenue and income both missed analyst expectations.

- The company mentions that its 3rd quarter earnings are a reflection of the integration of 21st Century Fox (21CF) into the organization.

- Increased expenses as a percentage of revenue and increased costs related to the 21CF transaction were the main drivers behind the decline in financial performance for the firm.

- Direct-to-Consumer and International had increased losses, which played a role in the decline in performance.

- Parks and Resorts had lower attendance across the board and domestic parks experienced a decline in operating income.

- Parks, Experiences, and Products segment operating income growth slowed to 4 percent. Last year Parks and Resorts had a 15 percent increase in operating income (Parks and

- Resorts was combined with Consumer products).

- Media Networks and Studio Entertainment had solid results and performed better than 2018 Q3.

- Company is ramping up investment in its streaming services division and preparing for the launch of Disney+ in November.

Above is a chart covering the financial performance of The Walt Disney Company for the 3rd Quarter (Q3) 2019.

The Walt Disney Company Segment Financial Results Review

Analysis of how Disney’s segments performed are covered in this section. Understanding the results of each section is key to seeing how each division is contributing to the overall financial performance of the firm.

Media Networks

In this quarter, Media Networks beat out Parks, Experiences, and Products to be the biggest segment based on revenues. Revenue for the segment came in at $6.713 billion and was 21 percent higher than 2018’s 3rd quarter’s revenue ($5.534 billion). Income was at $2.136 billion, which was 7 percent above Q3 2018’s results ($1.995 billion).

Media Networks – Cable Networks Division

Inside of Media Networks, Cable Networks reported a 24 percent increase in revenues ($4.464 billion Vs. $3.597 billion Q3 2018) and operating income increased by 15 percent ($1.637 billion Vs. $1.429 billion). The company reports that the integration of 21st Century Fox and higher ESPN income were the main components that allowed operating income to increase by 15 percent. Freeform’s results declined in the quarter, which impacted results slightly.

Increased affiliate and advertising revenue countered by higher programming and production costs were behind the financial performance increase at ESPN. The company also reported that viewership and subscribers were down for the quarter; however, the company was able to counter the results through increased advertising rates and units sold and affiliate rate increases.

Freeform’s decline was attributed to higher programming/production costs.

Media Networks – Broadcasting Division

Broadcasting saw its revenues increase by 16 percent from $1.937 billion to $2.249 billion for the quarter. Operating income declined by 17 percent from $369 million in 2018 to $307 billion in 2019. Disney is reporting that lower operating income was due to lower ABC studio sales and network advertising revenue. Increased affiliate revenue, a decrease in programming expenses, and the integration of 21st Century Fox helped support operating income from declining further: however. Walt Disney Co. also mentioned that division had lower viewership that was partially countered by higher rates.

Parks, Experiences, and Products

As one of Disney’s best performing segments, Parks, Experiences, and Resorts continued to have growth in revenues and operating income. Revenues were up 7 percent from the last quarter ($6.575 billion Vs. $6.136 billion) and income increased by 4 percent ($1.719 billion Vs. $1.655 billion). The segment’s positive results were supported by Consumer Products and Disneyland Paris. Domestic Parks was one area that did not perform well and had decreased operating income for the quarter.

Operating income increases at Consumer Products was related to the licensing income from Toy Story related merchandise and increases in the company’s comparable-store sales and online revenue. Increases at Disneyland Paris were due to Disney charging higher average ticket prices; which was countered by lower guest attendance at the resort. Lower attendance was a common theme across Walt Disney’s theme parks and resorts as domestic parks also reported lower guest traffic when compared to last year.

Disney reported that Domestic Parks had lower attendance and higher costs (labor costs, cost inflation, and Star Wars: Galaxy’s Edge costs). The decrease in attendance and costs were slightly offset by higher guest room nights and growth in guest spending due to higher admission prices and increased food, beverage, and merchandise purchases.

The company did not report on how its other international parks were doing including Hong Kong, Shanghai, and Tokyo.

Lower attendance was a major event that occurred during the quarter and is a key area to watch during the next quarter.

Above: Star Wars Galaxy's Edge land in Walt Disney World's Hollywood Studios before the launch. Photo copyright The Walt Disney Company.

Studio Entertainment

Studio Entertainment had a relatively solid quarter as revenues increased by 33 percent and operating income increased by 13 percent. Movies (Theatrical Distribution) and lower cost impairments were two areas that helped Walt Disney Co. achieve growth. The company’s movie line-up performed better than last year’s slate, which allowed the segment to have a solid quarter despite losses from 21st Century Fox’s operations and TV/SVOD and home entertainment declines. Disney is blaming Dark Phoenix for damping the performance of the segment.

Direct-to-Consumer and International

As the most important segment to the company’s future, Direct-to-Consumer and International reported increased losses that affected the firm’s financial performance in the quarter. The segment had significantly higher revenues of $3.858 billion compared to $827 million in the prior quarter. The large increase was due to the inclusion of Hulu in the operating results for the segment. Losses for the segment were $553 million, compared to $168 million in last year’s quarter. 21st Century Fox international channels helped to support financial performance; however, Star India negatively affected results.

The Walt Disney Company attributes the increased loss to the inclusion of Hulu, increased investment in ESPN+, and costs in preparation for the launch of Disney+ in November.

Above: The Disney+ Logo.

Cash Flow Analysis

Free cash flow and cash provided by continuing operations were both down for the quarter when compared to last year. Free cash flow for the quarter was -$2.925 billion compared to positive $2,459 billion last year. Cash from continuing operations was -$1.748 billion (+$3.679 billion Q3 2018).

For the nine months ending on June 29th, 2019, cash provided by operations was $4.266 billion, down from $10.422 billion for the same period in 2018 (59 percent decline). Walt Disney Co. attributed the decline to increased tax obligations from the 21st Century Fox spin-off of Fox Corporation, lower segment operating income, and increased payments for interest.

Free cash flow was at $699 million for the nine months, which is 90 percent less than the $7.178 billion the company reported during the 3rd quarter of 2018. Free cash flow was impacted by the lower cash from continuing operations and increased spending on investments in parks, resorts, and other property. The company invested $3.567 billion compared to $3.264 billion in last year’s quarter (9.3 percent increase).

Overall, cash flows were mostly impacted by the sharp decline in cash provided by operations.

Financial Analysis on Why The Quarter Did Not Meet Expectations

The Walt Disney Company missed expectations due to increased expenses and increased losses for its Direct-to-Consumer and International segment. The main driver that caused the company to have significantly lower income when compared to last year was the increased costs as a percentage of revenue. Costs of services increased to $11.445 billion and were 63.5 percent of services revenue compared to 54.2 percent in the prior year. Total costs and expenses as a percent of revenue also increased from 74.2 percent to 86.4 percent. Selling, general, and administrative (SG&A) expenses were also up in the quarter. In addition, the company had increased interest expenses, restructuring charges, and other losses. Those increased expenses were all related to the 21st Century Fox transaction.

Direct-to-Consumer and International had increased losses which affected segment operating income. Parks, Experiences, and Products also had somewhat slower performance, which did not help to cover for the performance of other divisions.

Analysis on What to Watch Going Forward

The Walt Disney Company had a mixed quarter that saw them miss analyst expectations and report significantly lower income when compared to last year. Key areas to watch going forward include expenses, 21CF costs, Parks and Resorts performance, and Direct-to-Consumer and International performance.

For 2019 Q3, the company experienced a significant increase in expenses that will need to be monitored going forward. The expenses are likely transitory as the company spends money on integrating 21st Century Fox into its operations. Costs will need to be looked at more closely during the 4th quarter of 2019.

Parks and Resorts showed signs of weakness during the quarter, which was concerning as the division had been one of the company’s best until this quarter. Guest attendance will be a key area to watch as the company prepares to open the new Star Wars: Galaxy’s Edge land in Walt Disney World Resort at the end of August.

Direct-to-Consumer and International will be the segment to watch as the company will be launching Disney+ in the quarter. Any early numbers on Disney+’s performance will be important to the company’s results.

Quarter Takeaway

The Walt Disney Company’s financial performance slowed down for the 3rd quarter of 2019. Disney saw its income and segment operating income decline as a result of mixed results from its divisions and increased costs from the 21st Century Fox acquisition. All eyes will be on the Direct-to-Consumer and International segment as the company launches Disney+ at the end of the year. If the company is able to have a successful launch of Disney+, control its costs, and have stable Parks and Resorts performance, it will be able to perform well during the next quarter.