Welcome to NavFile’s Walt Disney Company Financial Analysis report/article for Q4 2020. For the fourth quarter of 2020, Disney had another tough quarter as the company continues to be significantly impacted by the situation from COVID-19. This report has been prepared by David Aughinbaugh II, our research analyst. The report includes a PowerPoint presentation in PDF format of the quarter.

The Walt Disney Company Financial Analysis Q4 2020 Overview

Following our usual format, this report starts with the company’s revenue and income results. An analysis of the company’s performance compared to results that were expected from Wall Street. Key information is then covered in bullet point format. Each of Walt Disney Co’s segments’ results is then covered. Coverage of cash flows and what is expected going forward for the company is the last part of this article.

The Walt Disney Company 4th Quarter 2020 Earnings Summary

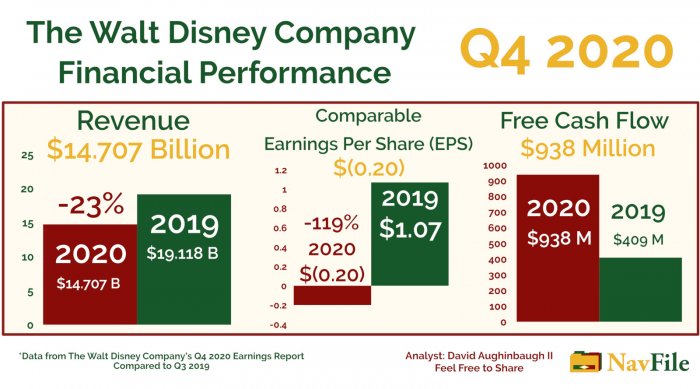

On November 12th, 2020, The Walt Disney Company reported its 2020 Q4 earnings. Revenues for the firm came in at $14.707 billion, a 23% decline from the prior-year result of $19.118 billion. For net income, the company reported a loss of $710 million compared to a gain of $777 million last year (from continuing operations). Diluted earnings per share (EPS) was $(0.39) compared to a gain of $0.43 billion from last year’s quarter. Diluted EPS excluding items affecting comparability was a loss of $(0.20) per share compared to a gain of $1.07 for Q3 2020. This was the first quarter during the COVID-19 cycle that the company reported a loss for comparable EPS.

Segment operating income for Disney was $606 million, down 82% from $3.425 billion last year. Cash provided by continuing operations came in at $1.667 billion, a decline of 3% from Q3 2020. Free cash flow was $938 million, a 129% increase.

Wall Street Financial Analyst Expectations

Analysts on Wall Street and the financial community expected Disney to lose $0.71 per share for comparable EPS and report revenues of $14.20 billion according to CNBC. The Walt Disney Company exceeded expectations and reported a 71% lower loss and a 3.6% higher result for revenues.

2020 Q4 The Walt Disney Company Financial Analysis Presentation

Slideshow/Powerpoint Presentation for The Walt Disney Company's 2020 Fourth Quarter Earnings (Financial Analysis) (PDF Format).

Video - Disney Q4 2020 Earnings Analysis by David

The Walt Disney Company Focuses on Its Growth Prospects

While acknowledging the mega challenges that they have faced, Disney focused on Disney+ and its Direct-to-Consumer offerings. The company is focusing on the growth that the Direct-to-Consumer segment is bringing to the company. By the end of the 4th quarter, Disney+ had 73 million subscribers and launched the service in Latin America after the earnings announcement. More information on the Direct-to-Consumer division and its future was covered during the company’s investor day presentation on December 10th. All of the company’s streaming services had a combined 120 million paid subscribers.

The company is also focusing on its DTC strategy by altering the structure of its segments into content creation and distribution segments. Production of studio projects have restarted and Disney plans on having 8 new projects started by January. TV content production has also resumed and 100 projects are in progress.

Parks and Resorts is climbing back as guests start to return to the open parks. As expected, the company is very disappointed in the State of California for not allowing them to reopen Disneyland.

ESPN had a strong showing as its live sports events were among the most-watched cable shows for the year. CEO, Bob Chapek, mentioned that half of the most-watched shows were for live sports. ESPN also had good results for its Digital and ESPN+ offerings. ESPN+ had 10 million subscribers by the end of the quarter (3 times the amount of subscribers for the year).

The focus for Disney will be its DTC strategy and the firm has unveiled more details on what it’s working on at its December 10th investor day conference. During the creation of this article, The Walt Disney Company provided more details on their direct-to-consumer offerings and the new content that they are creating for those platforms. Investors were very happy with the investor day presentation as the stock soared higher the next day.

The financial impact of COVID-19 was estimated to be $3.1 billion. Parks, Experiences and Products was hit by $2.4 billion, which is 77% of the overall impact. Media Networks was impacted by an estimated $500 million, which was mostly due to higher costs at ESPN from delayed programming. An additional week (53 weeks) for the fiscal year also impacted results slightly.

Above is a graphic the showing the financial performance of The Walt Disney Company during the 4th quarter of 2020 by David Aughinbaugh II. Revenue, comparable EPS, and free cash flow are covered in the graphic. Please feel free to share.

The Walt Disney Financial Analysis Q4 2020 (4th Quarter)

The Walt Disney Company reported a quarter that was much better than expected; however, the company is still incurring losses. For the quarter, the company reported a loss of $0.39 per share and a loss of $0.20 per share for comparable EPS. That was the first comparable EPS loss for the company this fiscal year. The fourth quarter was the worst quarter for the company in terms of the losses that they have reported. Revenues were $14.707 billion, down 23% from last year. Segment operating income was down 82%, which was a significant decline. For the year, segment operating income was down 45%. Most of the segment operating income declines have occurred in the recent quarters where the company is experiencing major impacts to its Parks & Resorts businesses. The largest segment operating income losses are from the Parks, Experiences, and Products segment, which recorded a $1.098 billion loss for the quarter and an $81 million loss for the year. Studio Entertainment saw its operating income decline by 61% for the quarter and 7% for the year. Direct-to-Consumer and International reported lower operating losses for the quarter; however, had an overall increase in losses for the year (53% increase). Media Networks was the lone segment to have an increase in operating income for the year and the quarter (21% and 5% respectively).

Direct-to-Consumer Continues to be the Focus

Disney’s Direct-to-Consumer offerings were the main focus for the company before the current CV19 situation arrived. Those services have been placed as an even high priority as the company adapts to the new environment that has severely impacted their resorts. With the reorganization of the company that was announced before the end of this quarter, the company looks to be putting more focus on content that can be delivered to their streaming platforms. An expanded lineup of shows and movies are likely in the pipeline. According to Disney, production has restarted on many projects. When Bob Chapek was asked on the earnings conference call whether Disney would be expanding its content lineup, he responded that new content usually brings in new customers. The company will continue to increase its investment in direct-to-consumer services, which means more content for those services.

Financial Analysis Review

Despite the loss, the company was able to beat Wall Street's expectations for revenues and income (loss). That was a positive as it seems that Walt Disney Co’s efforts to stabilize operations are working. It will have to be seen if the company can stop further losses in the next couple of quarters. Direct-to-Consumer may allow the company to be valued at higher multiples as they are adding a Netflix like subsidiary to the company. After their December 10th investor day conference, the company presented several new shows and movies that they will be creating for their direct-to-consumer services. With that presentation, investors seem to be focusing on the growth potential of the company’s direct-to-consumer division.

If Disney can stop losses at Parks, Experiences, and Products, they could be in good shape for next year. The company has pivoted to focus on Direct-to-Consumer and International, which could be a sign that they do not feel parks and resorts will be back soon. Once the losses for the company stop, Disney will be on good footing.

Key Information – 2020 Q4 Financial Results

This was the first quarter of the fiscal year where The Walt Disney Company reported a loss for comparable ($0.20) and regular ($0.39) EPS.

The company reported a loss of $1.57 per share for the year.

Disney beat Wall Street expectations of $0.71 comparable EPS loss and revenues of $14.20 billion. 71% lower loss and revenues 3.6% higher than expected.

Parks, Experiences, and Products was significantly affected by the COVID-19 situation as Disneyland California remained closed and Disneyland Paris was re-closed during the quarter.

Disney has pivoted even more toward their Direct-to-Consumer businesses and has made that segment a high priority for the company.

Disney+ had more than 73 million subscribers by the date of the earnings announcement (11/12/20).

Disney+ subscribers increased to 86.8 million by 12/10/20, the day of their investor day conference.

Walt Disney Co has 137 million subscribers for all of their streaming services.

Direct-to-Consumer and International’s revenues increased by 41% while operating losses declined by 23%. The lower operating loss was due to better results for Hulu and ESPN+, which was slightly offset by higher costs for Disney+.

Media Networks revenues and income increased by 11% and 5% for the quarter from last year.

Cable Networks revenues increased 11% and operating income decreased 7%. Income decline was mostly due to lower results for ESPN.

Broadcasting revenues increased 10% and operating income increased 47%. Operating income was up due to an increase in affiliate revenue and lower programming, production, and marketing costs.

Parks, Experiences, and Products revenues declined 61% and operating income was reported as a loss of $1.1 billion.

Studio Entertainment’s revenues for the quarter decreased by 52% and operating income decreased by 61%. Declines in movies and home entertainment were behind the declines.

Disney had $393 million in restructuring and impairment charges that were severance payments to those at Parks, Experiences, and Products and 21st Century Fox.

Cash provided by operations was $1.667 billion, down 3% from last year. Free cash flow was $938 million, up 129% from 2019 Q4. Lower investments in parks, resorts, and other property was behind the higher free cash flow.

The firm is still dealing with the effects of COVID-19. Parks and resorts are still being significantly impacted by the situation. It is unknown when the company will be able to open up parks in California and France.

Walt Disney World Resort is still operating at reduced capacity; however, the company has increased the capacity to 35% for the resort.

Segment Financial Results and Analysis

Parks, Experiences, and Products

Parks, Experiences, and Products was significantly impacted by the current economic situation due to CV19. The segment has been impacted the whole year and has taken the biggest hit from the CV19 situation. Revenues for the quarter were $2.580 billion, down 61% from $6.655 billion in 2019. Operating income was a loss of $1.098 billion, down from a gain of $1.079 billion last year. The revenue declines and operating loss were all due to the disruptions caused by CV19. Disney has not been able to open Disneyland California and had to re-close Disneyland Paris during the quarter. In addition, Disney Cruise Line has no restart date set yet.

The Walt Disney Company will continue to have trouble with its Parks, Experiences, and Products division as they will not be able to operate at much higher capacity soon. Operations will improve as people get back to traveling and visiting the parks. Based on the current trend, Disney will continue to see more guests return to the open parks.

Above photo by Disney. Used under the fair use provision

Studio Entertainment

Just like Parks, Experiences, and Products, Studio Entertainment was highly impacted by the economic situation. For the quarter, revenues were $1.595 billion, down 52% from $3.310 billion for Q4 2019. Operating income came in at $419 million, down 61% from $1.079 billion. Lower movie and home entertainment results were behind the declines in revenue and operating income. A large portion of theaters were closed during the quarter and Disney did not release any new movies. Home entertainment saw declines due to lower unit sales as a result of not having any comparable movies for the quarter.

Media Networks

Continuing the trend for the year, Media Networks continued its solid performance. Revenues were up 11% to $7.213 billion from $6.510 billion in 2019. Operating income increased 5% to $1.864 billion from $1.783 billion. The increase in revenues was due to better revenue performance at Cable Networks and Broadcasting. The better operating income results were due to significantly better results at Broadcasting.

Cable Networks

Cable Networks’ revenues were up 11% to $4.7 billion and operating income was down 7% to 1.2 billion. Lower performance at ESPN was the main factor behind the decline in operating income. ESPN was impacted by higher programming and production costs, which were slightly offset by affiliate and advertising revenue growth. MLB and NBA programming that was rescheduled to the 4th quarter caused costs to increase. That was slightly offset by deferral of rights costs due to the movement of college football games to fiscal 2021. ESPN affiliate revenue gains were due to an additional week in the fiscal year and an increase in contracted rates. Subscribers declined during the quarter.

FX Networks and Domestic Disney Channels had better results for the quarter. FX Networks had higher results due to lower production and programming costs. The lower costs were the result of fewer hours of original programming and decreased marketing costs. Domestic Disney Channels results were up due to the sale of shows and movies to Disney+.

Cable Networks had a decent quarter; however, the segment was not able to contribute to Media Network’s operating income.

Broadcasting

Broadcasting had a very good quarter. Revenues were up 10% to $2.5 billion and operating income was up 47% to $553 million. Affiliate revenue growth and lower marketing and network programming and production expenses were behind the gains. New accounting guidance lowered results slightly. Affiliate revenues were up due to higher rates and the gains from an additional week in the quarter. Production shutdowns, deferrals of programming, cancellations, and the move of college football games in the quarter to future quarters, a delay in season premiers, were behind the decline in costs. Advertising revenues were the same as last year; however, the division experienced lower average network viewership.

Broadcasting had a great quarter that was driven by higher rates and an additional week in the quarter combined with a decrease in costs.

Media Networks had another good quarter that was driven by Broadcasting and Cable Networks' relatively flat performance. The company lost subscribers for Cable Networks and Broadcasting had lower viewership, however.

Direct-to-Consumer and International

DTC and International had a good quarter that saw its operating losses decline and revenues increase.

Revenues were $4.853 billion, up 41% from $3.446 billion in 2019. Operating losses declined 23% to $580 million from a loss of $751 million. Better results at ESPN+ and Hulu, that were offset by increased costs at Disney+, were behind the increase in performance. Hulu had increased subscribers and advertising revenue which was slightly offset by higher programming costs. ESPN+’s results were positively impacted by gains in subscribers and income from Ultimate Fighting Championship events.

On 11/12/20, the company had 73 million Disney+ subscribers and 86.8 million subscribers on 12/10/20. Total combined subscribers for the company was 137 million on 12/10/20.

International channels experienced a decline in results that was caused by lower advertising and affiliate revenue. Those declines were slightly offset by a decrease in general and administrative costs and bad debt recoveries.

DTC and International did well as Disney+, Hulu, and ESPN+ are gaining subscribers. Revenues are increasing and losses are declining with increased subscribers.

Q4 2020 Cash Flow Analysis

For the quarter, cash provided by operations was $1.667 billion, down 3% from $1.718 billion in Q4 2019. Investments in parks, resorts, and other property was down $580 million to $729 million (44% decline). Free cash flow was $938 million, up $529 million (129% increase). The increase in free cash flow was due to the significant decline in investments.

2020 Q4 Financial Performance Overview of The Walt Disney Company

The Walt Disney Company had its first quarter of the year where it reported a loss for comparable EPS. Disney was able to beat expectations for the quarter, which was a good sign that the company is headed in the right direction. Direct-to-Consumer had a good quarter with its increase in subscribers and revenues and a decline in operating losses. Disney+ reached 73 million subscribers by the day of the earnings release. The company has shifted more of its focus to its streaming services and will be increasing the amount of content that those services have. Parks, Experiences, and Products has started to improve; however, the issues associated with CV19 remain in place. Disney will not begin a full recovery unless the recovery at PEP starts to pick up. Direct-to-Consumer will allow the company to grow and it may allow the company to be valued at higher multiples as the company is adding a Netflix-like subsidiary to the company. Studio Entertainment was impacted as most movie theaters remained closed for the quarter. Media Networks did well; however, is losing subscribers.

Future Analysis and What to Watch For

Going forward, Parks, Experiences, and Products and Direct-to-Consumer will be the key segments to watch. PEP will provide insights on when the company will embark on making a full recovery. If Direct-to-Consumer continues to accelerate its subscriber growth, the company could be valued at a much higher multiple.

COVID-19 has affected Disney greatly; however, it is turning to at-home plays to keep the firm moving forward.

Information for this article is from:

- The Walt Disney Company Q4 2020 Earnings Report and Transcript. It can be found here.

- CNBC article regarding the Q4 earnings here.

- Disney investor day conference here.